Investment Philosophy

Here is our investment philosophy, which describes our approach to the provision of investment advice. It outlines our beliefs about investment which form the foundations of how we manage your money. It also has details about how you are involved with the decisions about investing; after all it is your money.

If you don’t understand anything here please ask us, there is no such thing as a silly question when it comes to looking after your money!

Our beliefs No. 1

Investors should understand the reasons for investing and how their portfolio is designed to meet their goals. The world of investing can be complex and often not transparent. We believe in keeping things simple. So while there is a lot of science and evidence behind our investment philosophy and process, we are keen that every client understands our recommendations and how they fit with their own financial objectives.

The first step of any investment philosophy is to understand the customer’s needs. We explore this via a conversation with you and look into factors such as:

- your need for capital security

- your age

- your family commitments

- the need for income and / or growth and any future regular income needs

- whether there is a specific item that needs funding e.g. school fees

- your investment time horizon

- your exposure to interest rate risk and inflation risk

- the impact of charges and penalty fees

- your attitude to risk, risk tolerance and capacity for loss

When delivering investment advice, we always start with a detailed understanding of your financial planning objectives. These influence decisions about the level of investment risk that needs to be taken.

Our beliefs No. 2

A conversation about risk and its many dimensions is the essential first step when investing. When it comes to investing, risk and reward are inextricably entwined. Don’t let anyone tell you otherwise. All investments involve some degree of risk – it’s important that you understand this before you invest.

The reward for taking on risk is the potential for a greater investment return. If you have a financial goal with a long time horizon, you are likely to do better by carefully investing in asset categories with greater risk, like equities, rather than restricting your investments to assets with less risk, like cash. On the other hand, investing solely in cash investments may be appropriate for short-term financial goals. To help understand risk we break it down into four elements:

Investment risk. These are the risks associated with different types of investment. There are many different risks (and rewards) but common ones include: volatility – the ups and downs; liquidity risk – can you get your money back when you need it; company risk – the risk that one company goes bust; default risk – the risk that a bond doesn’t pay you back; emerging market risk – the fact that some markets are less efficient and transparent.

The need for risk. All these risks might start to put you off. But even investing in cash carries risk e.g. inflation risk – your spending power goes down; default risk – your deposits may not be 100% safe. For some investors, and certainly for short term savings, cash is still likely to be the best fit with your needs and objectives.

Your attitude to risk. Risk attitude has more to do with the individual’s psychology than with their financial circumstances. Some will find the prospect of volatility in their investments and the chance of losses distressing to think about. Others will be more relaxed about those issues.

Your ability to tolerate risk / accommodate losses. If things go wrong what would that mean to your finances? You may be a risky investor but can you afford to be? You may be a risk adverse investor but are you saving enough? This is about understanding your ability to withstand the shocks that might come along with the aim of ensuring your portfolio meets your capacity for risk.

Generally speaking, a person with a higher level of wealth and income (relative to any liabilities they have) and a longer investment term will be able to take more risk, giving them a higher risk capacity.

Your ability to tolerate risk is very different to your attitude to risk – understanding this is a key part of our investment process. A conversation with you will help inform decisions about the level of investment risk that needs to be taken and that you can afford to take, rather than simply the maximum amount of risk that you feel happy with.

We will use a specialist risk profiling tool to help us establish the risk profile that is right for you. But we will also have a conversation with you about the profile to make sure that you understand what it means and how the profile needs to change to meet your particular situation. The great benefit of the tool is that it creates an unbiased view of your risk profile, and therefore is an excellent starting point for the conversation.

Our beliefs No. 3

Investing for the long term is very different than saving for the short term. While there is an understandable desire to keep things safe when investing, the corrosive impact of inflation and thus the value of investing for the long term in more risky assets are compelling.

Real assets such as equities, property and commodities tend to make a better investment than the apparently safer option of cash deposits in the long run, but it isn’t that simple.

In the last 50 years Equities have outperformed Gilts.

Table 1. Real returns (after inflation) over 50 years %pa.

| Asset class | Return |

| UK Equities | 5.5 |

| Gilts | 2.7 |

| Cash | 1.6 |

Source: Barclays Research 2013

But it isn’t the case over every time period – for example over the twelve most recent 10 year periods going back to 1902 (1902 – 1912, 1912 – 1922 etc.) – Equity returns were better than Gilts eight times, whereas Gilts beat Equities four times.

Our view is that basing investment decisions on the longer term historic behaviour of asset classes enables investors to participate in market growth. But that regular review is critical.

Our beliefs No. 4

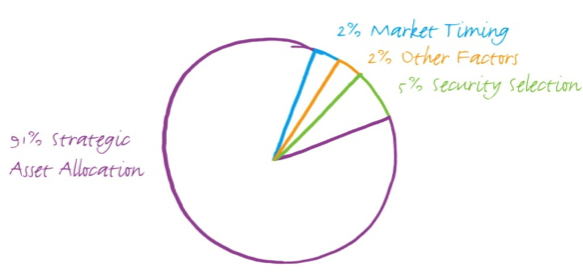

The bulk of long-term returns come from asset allocation. Academics will continue to argue about the precise amount of value that comes from strategic asset allocation rather than stock selection, investment style or market timing, but it is widely accepted that asset allocation has the biggest influence over the variance in portfolio returns.

(see appendix for more)

This means that investors and their advisers should be devoting the bulk of their effort to constructing the most suitable asset allocation model, based on individual investment objectives and individual attitude towards investment risk. This is where we focus our attention when delivering investment advice.

It’s like making a cake. The most important part is making sure you have the right amount of flour, eggs, butter etc. rather than worrying whether the ingredients come from Harrods or the corner shop.

We use the risk profiling tool to propose a suitable asset allocation to meet your needs based on long term historic information. We will discuss this with you to make sure that you are comfortable with the recommendations.

Our beliefs No. 5

Diversification using mainstream asset classes can reduce risk without destroying returns. Diversification is a strategy that can be neatly summed up by the timeless adage “Don’t put all your eggs in one basket.” The strategy involves spreading your money among various investments with the intention that if one investment loses money, the other investments may more than make up for those losses.

A diversified portfolio should be diversified at two levels: between asset categories and within asset categories. So, in addition to allocating your investments among stocks, bonds, cash, and possibly other asset categories, you’ll also need to spread out your investments within each asset category.

Investors may find it easier to diversify within each asset category through the ownership of mutual funds (unit trusts), rather than through individual investments from each asset category. A mutual fund is an investment vehicle that pools money from many investors and invests the money in stocks, bonds, and other financial instruments. Mutual funds make it easy for investors to own a small portion of many investments. A total stock market index fund, for example, may own stock in hundreds of companies. That’s a lot of diversification for one investment.

We use specialist fund managers to build portfolios, that are diversified at both asset class and stock level. But importantly they stay close to the asset allocation outcome which has been determined as appropriate for you.

The use of these so – called multi-asset approaches has the benefit of “automatic rebalancing” inside the fund wrapper. This means that the asset mix of these portfolios stays true to the asset allocation that meets your risk need, and is often conducted at lower cost than we can probably achieve by rebalancing it directly. (It will take us some time to implement the switches for each client and each fund in each tax wrapper – automatic rebalancing reduces this cost (and is especially efficient for smaller portfolios). Also that fact that switching portfolios outside the fund wrapper which could lead to Capital Gains Tax (CGT) liability is removed.

Our beliefs N0. 6

Costs are certain and returns are not – so they deserve your attention.

Costs are certain and fund performance is not. It therefore makes sense to reduce costs wherever it is safe to do so. One of the major issues in fund management is that not all the costs are transparent.

There are three main costs with investing in funds:

1. the Annual Management Charge (AMC) – is the fee that the manager charges;

2. the Total Expense Ratio (TER) – this is the AMC plus legal, audit, depositary, safe custody and other costs;

3. trading costs – these are the costs of buying and selling the investments inside a fund. These include stamp duty, bid / offer spreads, stockbroker commissions, the costs of settling transactions etc.

Even though TERs are not the whole cost of running a fund, they are a powerful predictor of fund returns.

Understanding and seeking to reduce costs where safe to do so is a key part of our investment process.

Our beliefs N0. 7

Tax and access are important

Making investment tax efficient is a sensible objective and wherever we can we will try to reduce the tax your investments will pay. Use of pension wrappers and ISAs will assist in this objective.

We also use new technology platforms, known as wraps or fund supermarkets, to hold your investments. These offer safety, access to your valuations (so you can see how your investments are doing) and tax wrappers (pensions and ISAs for example). They also allow us to move your money between funds cost effectively if we need to in future.

Our beliefs No. 8

Active management and passive strategies can both play a valuable role.

There is a role for active (where the fund manager tries to beat the market, but incurs higher costs), and passive funds (which track the index at low cost) within a well-managed investment portfolio.

Rather than take an evangelical view of one option over the other, we appreciate that there are arguments for both approaches and accordingly we include both strategies in the portfolios we recommend.

Our preferred approach is to use multi asset funds to form the core of an investor’s portfolio. In some cases the whole portfolio will be constructed from multi asset funds, especially with smaller portfolios to maximise effective diversification, and at lower risk profiles. As a customer’s risk profile increases we may add active funds which have the potential for higher returns, though the costs will be higher and the risk of not matching the performance of the asset profile will be increased.

To use the jargon – this is about optimising your governance and risk budget – or more simply tailoring the best solution to your needs and financial goals.

Our beliefs No. 9

Investment success comes from the consistent application of a robust process.

There are numerous ways to approach the construction and on-going management of an investment portfolio. Without the application of a robust process, the emotional aspects of investing can prevent investors from making the best decisions. As a firm, we consistently apply a multi-stage investment advice process designed to deliver suitable advice to every client. The outcome is tailored to meet individual objectives but the process itself is always the same.

As with any plan we need to regularly review progress to make sure we are on track. We will discuss and agree with you the best way to achieve this.

Our beliefs No. 10

Success is often about the things you don’t do as much as the things you do.

We have some simple rules that we apply to all portfolios unless the clients specifically request a different approach:

No individual bonds / shares

No direct hedge funds

No direct unauthorised funds

Only use funds run by FCA regulated managers

If you don’t understand anything here please ask us, there is no such thing as a silly question when it comes to looking after your money!

Risk Warnings.

All investments carry risk. These are a few of the important ones.

The risk that the buying power of your capital decreases over time.

The risk that the growth you experience is variable.

The risk that you might get back less than you invested.

The risk that you do not achieve one of your objectives.

Appendix:

Three academics, Brinson, Hood and Beebower (1986, Financial Analysts Journal), who studied the performance of 91 large US pension plans between 1974 and 1983, analysed the impact of key decisions made by investment managers: long term asset allocation (i.e. 60% in equities, 40% bonds), stock picking and short term tactical changes to the asset mix. The results concluded that 90% of return and risk in a given fund was determined by the long term asset mix, with both stock picking and short term tactical changes having a negligible impact.

Download a PDF of our investment philosophy Investment Philosophy PDF Download